These days, it’s hard to find a consumer brand without a loyalty program. They’re table stakes and consumers aren’t discerning. Currently, the average consumer belongs to 17 loyalty programs (Statista). And, we’re guessing here, but we bet many consumers are enrolled in loyalty programs among competitors, like multiple grocery chains.

Both consumers and brands are ready for something new:

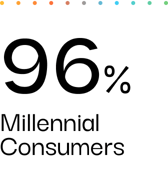

96 percent of millennial consumers want companies to find new ways to reward their loyalty (KPMG)

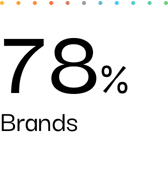

78 percent of brands have an interest in redoing, enhancing, or updating their customer loyalty offering (Loyalty360).

Deeper, personalized, and truly differentiated experiences – powered by flexible, purpose-built platforms that don’t trade revenue for value – herald the next generation of programs. Here are four ways that consumer brands can go beyond traditional points systems and co-branded cards to increase customer lifetime value (CLV):

In-store check cashing and cash loading

Brick & mortar retail locations that provide check cashing and cash loading offer more opportunities for consumers to engage in-person. Especially when combined with cashback rewards, these programs provide a range of incentives to increase foot traffic. For example, a national chain of convenience stores can offer in-store check cashing, with the option to load funds onto cards and accounts.

- Benefits to the consumer: According to a 2019 report by the Federal Reserve, 22 percent of American adults (63 million) are either unbanked or underbanked. With in-store check cashing at their favorite C-store, unbanked customers no longer wait in lines or pay exorbitant fees at check cashing locations.

- Advantages for the brand: Stores see an increase in foot traffic and, by placing loaded cards immediately in the hands of customers, see increased in-store spending.

Prepaid virtual cards

Rather than manage the distribution and waste of physical cards, offer prepaid virtual cards that via apps and e-wallets as loyalty accounts. This borrows a page from the Starbucks playbook, where customers deposit funds into their account for future coffees. A different example is a national quick service restaurant (QSR) offering virtual cards for customers to prepay for meals and earn points.

- Benefits to the consumer. Members can easily connect existing cards to fund the new loyalty account. They preload funds and earn points for their next fast food purchase.

- Advantages for the brand: Customers can load funds in advance, encouraging them to eat at the QSR more often.The QSR can leverage customer deposits by earning yield. For example, Starbucks customers have more than $1B sitting in virtual cards, essentially creating an interest-free loan to Starbucks.

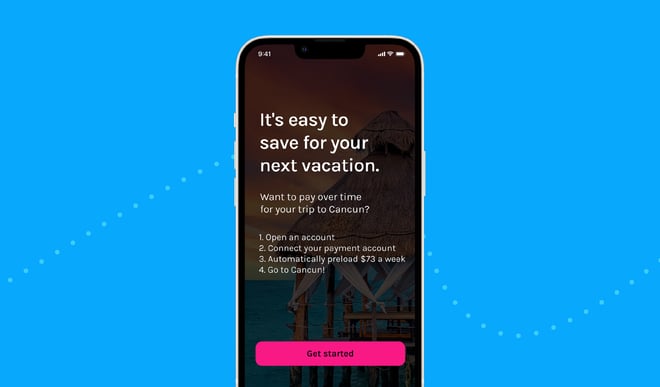

Save Now, Buy Later (SNBL) accounts

These accounts allow consumers to create wishlists of products or services they want and fund the purchase by loading incremental funds over time. Unlike a buy now, pay later (BNPL) model, this doesn’t require a customer to take on more debt. (In fact, these accounts can also earn yield.) An example application is a travel website offering accounts so customers can save for their next vacation.

- Benefits to the consumer. The convenience of an auto-deposit to the account each week or month to save for a trip, without the worry of whether they’ll be able to afford hefty bills later on.

- Advantages for the brand: A new alternative to co-branded credit card programs, which have strict qualification requirements, limiting participation by many consumers. This type of loyalty program incurs almost no risk, as trips cannot be purchased if consumers do not save enough funds.

These are just four examples of how to transform current loyalty programs by partnering with an embedded finance provider like Alviere. For a deeper dive on the challenges brands face with loyalty programs today and ways they can differentiate and innovate for sustained success, read Next generation loyalty programs: Transforming incentives to increase customer lifetime value. If you’re already considering embedded finance as an innovative tool to transform your loyalty program, connect with an Alviere expert to see how we can help.