Stepping out of your Uber without having to worry about digging for cash or how much to tip is freeing (although not free). The whole experience is very convenient and stress-free. Better still, while en route, you can order a venti macchiato through your Starbucks app and earn rewards at the same time.

Pioneering companies like Amazon and Shopify realized long ago that a surefire way to keep customers loyal is by streamlining payments — e-wallets and stored bank information made spending a breeze. And now, non-financial businesses like Uber and Starbucks have entered the world of financial technology (aka fintech) to improve the customer experience. Thanks to fintech, embedded banking is becoming mainstream.

Learn more about how embedded finance works, the advantages of embedded finance for both customers and companies, and how non-fintechs can integrate the technology into their platforms or business.

What is embedded finance?

Embedded finance seems to have crept up and taken the traditional financial powerhouses by surprise. By offering financial products through a technology platform, or separately, financial services are integrated directly into the products of retailers and other businesses.

Non-financial enterprises can remove the reliance on traditional banks with direct payments through an app or website. Embedded finance allows any company to offer financial services directly to their customers. This improves the customer experience as well as the customer-business relationship.

With embedded finance, companies can offer the same services as a bank. These services extend to accounts and wallets, online or in-app payments, branded cards, and global money transfers.

Embedded finance is still emerging, but the value is already being recognized. Many companies are integrating solutions with their existing infrastructures.

In fact, a recent study that polled 205 senior decision-makers with responsibility for tech innovation found that 29 percent of businesses already include financial services as part of their product offerings, and that number jumped to over 50 percent for the most innovative companies.

More than half claimed that they would move toward embedded finance in the next 12 months to expand revenue streams and build their customer base. Payments are faster, more convenient, and streamlined. Clearly, the barriers have been further broken down as non-financial embedded banking adopters are now offering financing services to their own customers.

How does embedded finance work?

There are many aspects to embedded finance, but what they all have in common is the convergence of commerce, the customer, the business, and finance. Here's a rundown of the more common examples of embedded finance.

Embedded payments

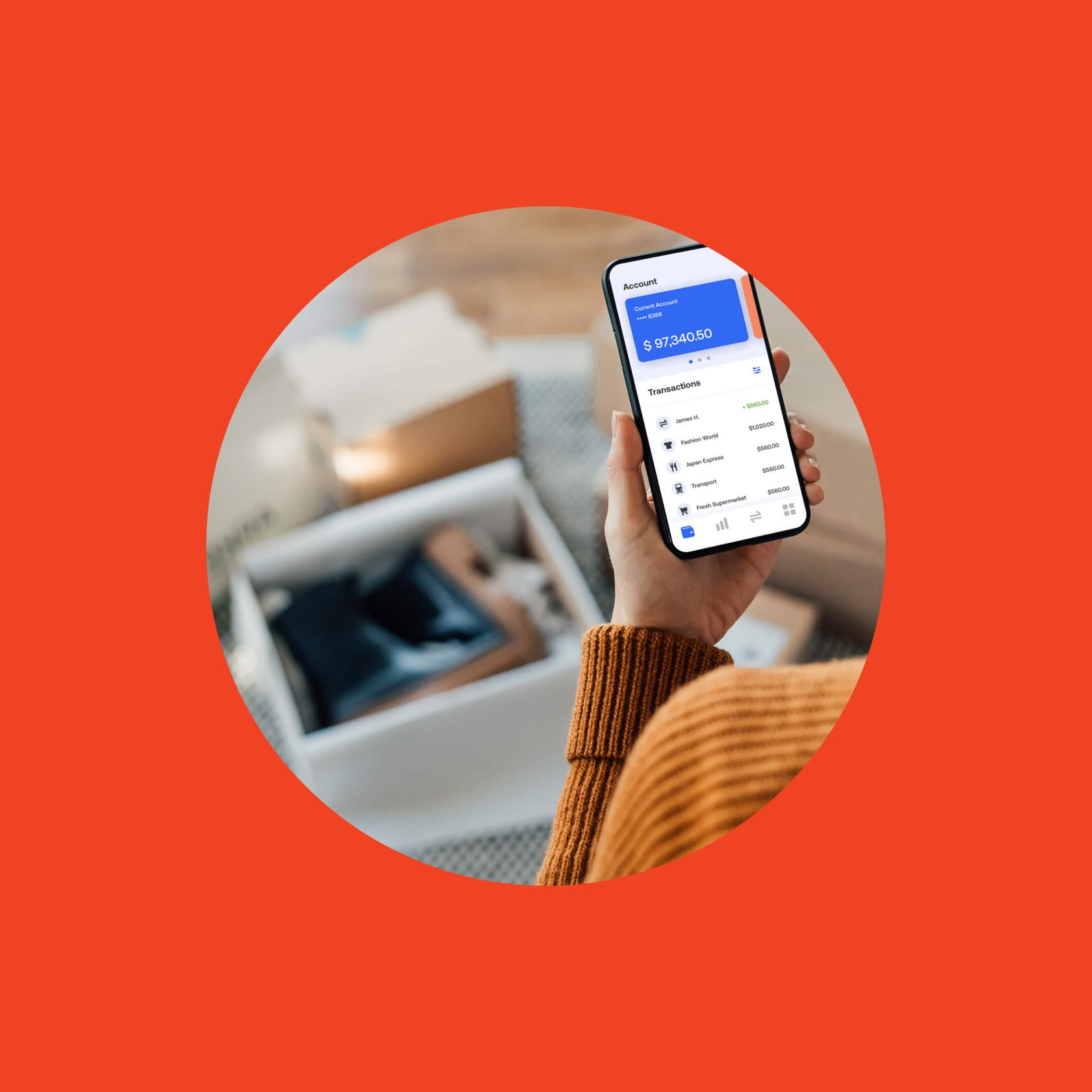

Embedded payment services, like those made at Uber or Starbucks, are the most prevalent due to their ease of use. Payments are made through an API or an app while a digital wallet contains the customer’s bank account information. The customer pays by tapping their phone at a point-of-sale, or tapping a few buttons on their phone to trigger the payment.

Embedded banking

Younger generations rarely stand in line at the corner bank and fill out reams of paper to open a bank account. Instead, they have a cup of coffee, go to an app on their phone, register in minutes, open a bank account, and request a debit card. The process is quick with few hassles and very few questions asked. It’s a seismic shift in customer behavior.

Wages and salaries are other examples of changes in banking behavior. Employees or contractors no longer need to be paid by check or have their cash deposited to a checking account. For instance, Lyft instantly pays drivers through its platform, and drivers can also apply for a separate savings account through the program. Meanwhile, Shopify offers a separate bank account to its small business owners so they don’t have to use their personal checking and savings accounts.

Embedded financing

Getting a loan or credit card used to require being qualified by a financial institution or online lender. Now, credit can be had from e-commerce sites right at the point of purchase. For instance, Klarna offers monthly payments in four installments when customers make a purchase. Retailers like Walmart and Afterpay offer buy now, pay later (BNPL) options.

Acorns is another example of embedded finance changing the financial services landscape. This digital banking program allows people to automatically invest and earn rewards by rounding up purchases when they buy everyday items like gas and groceries. Consumers can build exchange-traded fund (ETF) portfolios for $3 a month, and the portfolios automatically rebalance themselves periodically so consumers don’t have to pay attention to the markets.

Moreover, embedded finance is allowing businesses to save other businesses. Shopify Capital, according to TearSheet, funded a small Canadian company to the tune of $200,000 when it was hit hard by the COVID-19 pandemic using its technology without the need for wire transfers and bank fees.

Why does embedded finance appeal to consumers?

One word: Convenience. In a customer-first culture, now is the perfect time for embedded finance. Not only does it make the customer experience more enjoyable, it also means there's no more fumbling for a credit or debit card with one hand when you’re clutching a macchiato in the other.

There’s also the speed of accessing financial services that don’t require filling out endless bank forms and waiting to qualify. To save, spend, and send money all in one app is convenient yes, and empowering to those who may not have access to traditional banking.

Why does embedded finance appeal to businesses?

Companies can attract — and keep — customers by offering embedded finance services through mobile apps. Embedded financing, payments, reward programs, and remittances add new revenue streams. Offering additional services to customers also deepens the client relationship. And with each engagement via financial products, companies stay relevant and top-of-mind. Embedded finance even supports international money transactions for global reach.

Embedded finance is an exploding industry. A recent study by Lightyear Capital predicts that embedded finance could reach $230 billion in revenue by 2025 and $1 trillion in value. Consumers will learn to expect these types of services, and companies that don’t offer them risk clients turning to competitors that do.

How can companies embed financial products?

So, how do non-fintech companies add financial products for their customers? Companies like Alviere make integration easy for companies because they manage the whole process. That way, you focus on what you do best.

Whether you choose to embed accounts and wallets, real-time payments, a branded card, or the ability to manage global payments, Alviere will make it happen while you focus on growing your customer base.

Embark on the journey to offering financial products

The rise of digital made it possible for consumers to make instant payments with just a phone and an app. Now, we’re at the point where large enterprises and Fortune 1000 companies can — and should — be part of the fintech ecosystem.

Businesses that streamline their payment solutions and become a financial services provider build a broader customer base and retain loyal customers. Those that don’t afford the same convenience and connectivity for their clients will find it difficult to compete in the marketplace as consumer demand continues to fuel financial innovation.

Let Alviere guide your journey to embedded finance.