When you go to 7-Eleven for gas and a snack, you’ll see subtle advertisements at the pump and in-store that offer easy ways to send and receive money, turn cash into cards, buy gift cards for friends and family, or grab a prepaid debit card.

While 7-Eleven is known as a convenience store for quick food, snacks, and beverages, under the hood, it’s become a financial products and services powerhouse. 7-Eleven has turned its 78,000+ locations around the globe into both Slurpee destinations and financial services super convenience stores.

In this article, we detail the financial products and services 7-Eleven offers, how it integrates them into a rewards program, and most importantly, what could be next.

Grab your Slurpee, and let’s dive in.

7-Eleven began their journey into financial services in 1984, when it partnered with Western Union to offer money orders at select stores around the U.S. Since then, the C-store added an arsenal of financial services that help millions of customers send and receive money, turn cash into cards, buy gift cards for friends and family, and much more.

Here is 7-Eleven’s current list of financial products and services:

(Note, all might not be available at every store)

Prepaid debit cards

The Trans@ct by 7-Eleven Prepaid Mastercard® is a reloadable prepaid debit card that can be used to make purchases at 7-Eleven stores and other merchants that accept Mastercard. The card also has features such as direct deposit, online bill pay, and fraud protection.

In addition to the revenue that 7-Eleven generates from the sale of its prepaid debit cards, the company also earns money from the fees that customers pay to use the cards. These fees can include reload fees, ATM fees, and foreign transaction fees.

Money orders

Customers can send money to friends and family members with money orders issued inside a 7-Eleven store. Money orders are a safe and secure way to send money, and they can be purchased with cash, debit, or credit cards.

Bill pay

Customers can pay their phone or utility bills in-person at the store, a convenience for customers who do not have access to online bill pay, need to use cash, or who prefer to pay bills in person.

Wire transfers

Customers can send money to other people or businesses through wire transfer services at select stores. This service is convenient for customers who need to send money quickly and securely.

Money transfers

Similar to wire transfers, customers can use 7-Eleven for money transfers, which are similar to wire transfers, but have differences in speed, cost, and the rails that move the money.

Less expensive than wire transfers, money transfers also allow 7-Eleven customers to send money to other people or businesses quickly and securely.

Gift cards

7-Eleven stores sell a variety of gift cards that can be used to purchase merchandise at 7-Eleven stores. Gift cards are a convenient way to give or receive gifts, and they can be purchased with in store, online, or through the app with cash, debit cards, or credit cards.

The most popular are prepaid debit cards, money orders, and gift cards.

Why?

They are convenient and affordable for 7-Eleven’s unbanked and underbanked customers who need access to financial services. Transacting in a largely cashless economy, 7-Eleven provides convenient access to financial products to make its customers' lives easier. Easier to purchase online or in stores using a debit or gift card. Easier to securely send money, especially to those living in other countries. And easier to give gifts where they can be used to make purchases at a variety of stores.

While these services play a huge role in 7-Eleven’s ability to serve millions of people in different ways, they are separate from the core business. Most services are offered through a wide variety of partners, and let’s face it, there’s no free hotdog tied to a money order.

Enter the 7-Eleven rewards program.

As of March 2023, over 70 million people in the United States have signed up and actively use the rewards program.

Members get perks like:

- Points for every dollar spent that go to drinks, snacks, and more

- Exclusive discounts and coupons

- Birthday rewards

- Free Slurpees

- Early access to new products and promotions

These are great ways to gamify purchases and get loyal customers back in the door, but taking what we’ve learned from Starbucks (the bank that sells coffee), the ultimate way to keep customers coming back is to integrate fintech into rewards experiences.

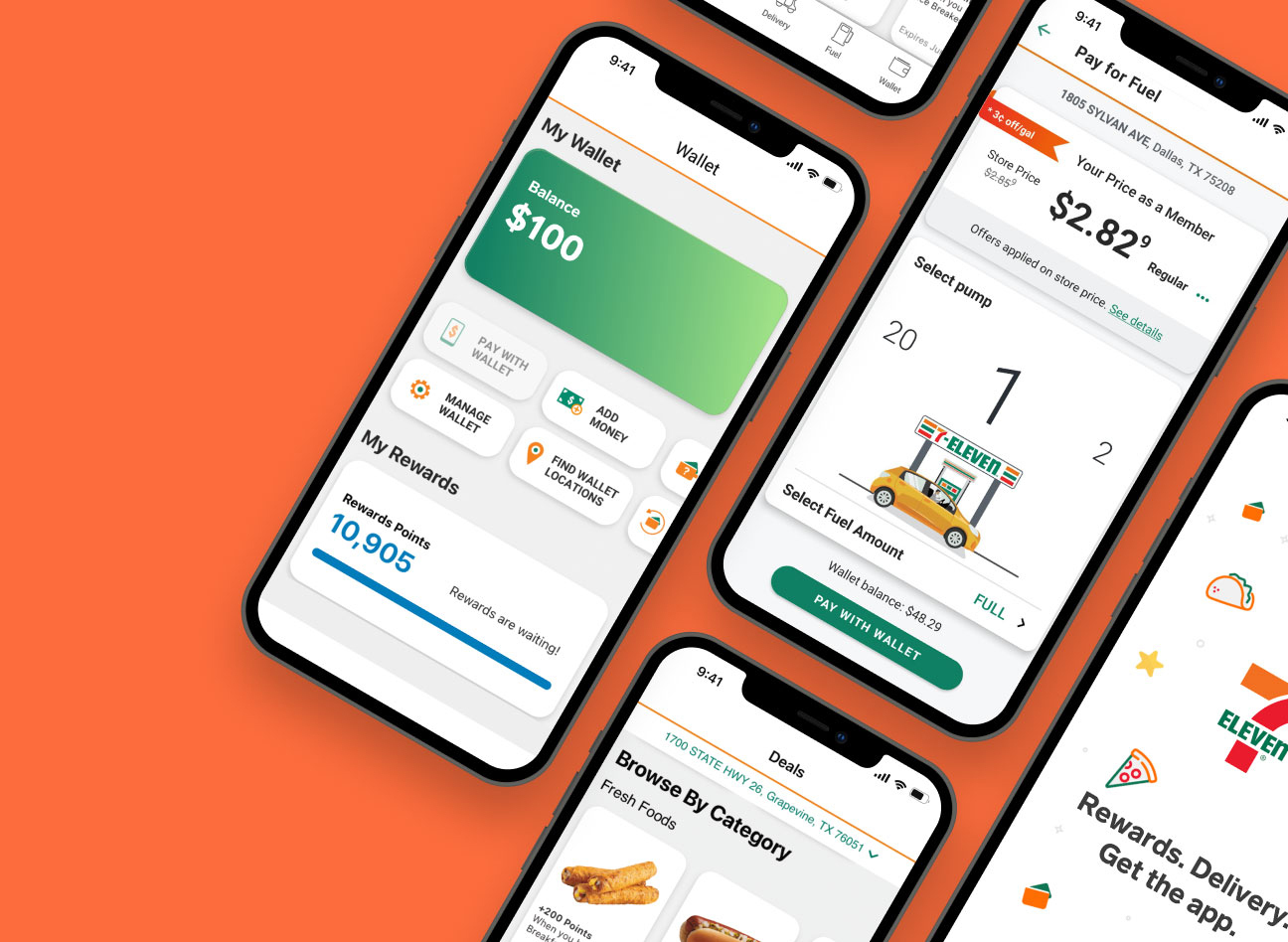

Fintech integration into rewards: The 7-Eleven Wallet

Adding simple fintech like eWallet functionality to app-based rewards can have a huge impact on customer loyalty. 7-Eleven has knocked it out of the park by giving customers rewards points for simply loading money into their account in the 7-Eleven app. Currently, for every $10 you load into your 7-Eleven Wallet, you will earn 100 points.

For rewards fanatics, this could be the easiest way to get rewards of all loyalty programs available and, for 7-Eleven, it’s the most effective way of guaranteeing future sales.

How can customers load money?

7-Eleven makes it easy: customers load money into their 7-Eleven Wallets at any participating store. They can load funds using cash, credit, debit, or a 7-Eleven gift card. They can also use card-linked methods to transfer money into their wallet directly in the 7-Eleven app.

Note, funds in most retailer app-based wallets can only be used for purchases at the retailer’s stores and technically function as reloadable gift cards. These “closed-loop” gift cards enable consumers to hold money in their account without having to go through Know Your Customer (KYC) and identify verification processes.

Five ways 7-Eleven can innovate

-

Use an embedded finance provider for the card programs. Using embedded finance technology to power its gift and prepaid debit card programs create better customer experiences, add more revenue share, and provides access to deeper customer spending insights.

-

Integrate global money transfers into the app. Adding functionality to let customers remit money overseas would make it extremely easy for customers to send money digitally, and give 7-Eleven more revenue potential without having to partner with Western Union.

-

Set up in-store check cashing and money loading. For open loop prepaid debit cards, 7-Eleven would either have to become a registered Money Services Business (MSB) or partner with an embedded finance provider who has money transmission licenses (MTLs)

-

Offer a 7-Eleven debit card program. Adding a basic banking suite under the 7-Eleven brand would give many customers access to basic financial services.

-

Enable P2P payments within the app. 7-Eleven could add person-to-person payments functionality to the app, similar to Venmo or CashApp. This would increase app usage and give 7-Eleven the opportunity to run in-app engagement programs.

Any one of these innovations would help 7-Eleven keep its customers loyal with continued convenient, affordable services both at their fingertips and at the store. Embedding financial services create a more direct relationship with consumers and drive business back to 7-Eleven.

The challenge? Trying to piece together the financial and technology partners to make this happen. That’s where an enterprise embedded finance platform like Alviere can help. Our team has helped consumer brands like Coppel, Boost Mobile, and AutoPayPlus keep customers loyal with tailored financial programs and we're always glad to discuss innovation over a coffee or a Slurpee.

Source: