Co-branded debit cards are quickly becoming a popular tool of choice for brands looking to enhance their loyalty programs and offer new and innovative card-based loyalty offerings.

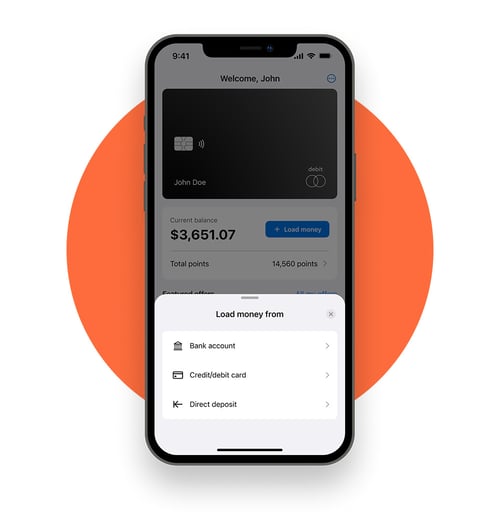

Compelling rewards and access can attract customers to co-branded debit cards, but the need for funds to be available pre-card swipe makes a seamless funding experience paramount to a co-branded debit card program.

In this article, we'll dive into the world of co-branded debit card funding. You'll learn about five critical funding methods that every program should offer to cater to a wide range of customer preferences. We'll also explore the impact of different funding methods on user experience, including settlement times and associated costs. You'll be equipped with the knowledge to design a co-branded debit card program with a frictionless funding process that drives card usage and program success.

Throughout this article, we sprinkle in real-life examples of how different funding methods can impact customer experiences, program adoption, and card usage.

Real-life example:

Picture this - the co-branded debit card your team has worked on for the last six months is gaining awareness, with user adoption on the rise. One of your latest merchant-funded rewards offerings, 10 percent off Airbnb bookings, is getting great engagement, but a less than stellar funding experience is stopping customers from topping up their account and converting.

Companies like Dollar General, Starbucks, Cash App, Walgreens, Boost Mobile, Coppel, and other brands who run successful debit-based card loyalty programs put a tremendous amount of time and resources into the card funding process to ensure a smooth and efficient experience, ultimately driving card usage.

While there are many elements to the funding experience, offering a variety of funding methods is a critical driver of card usage. Going back to the Airbnb merchant-funded reward example, some customers might want to use a bank account transfer to load their account, while others might want to use a different card loading method, or deposit cash to fund the card. Giving multiple funding options will maximize the number of customers who take advantage of the offer.

5 types of funding methods that are crucial for co-branded debit card programs:

1. Bank transfer

Customers can transfer funds from a different bank using account and routing numbers. These can be one-time transfers or automated, depending on the sending bank’s technology offering.

At Alviere, we partner with Plaid to enable our clients’ end-customers to link bank accounts to make bank transfers frictionless.

Example: Through account-linked funding, Sarah connects her Chase account to her retail app and periodically transfers funds when her account needs to be topped up.

2. Direct deposit

By using a demand deposit account as the type of account connected to the co-branded card, customers can assign a portion of their paycheck to be deposited into their co-branded debit card account.

Example: Mary, a mother of three, has a monthly budget of $1,000 for groceries. To take advantage of the deals and the added value her local grocery store has with its co-branded debit card, Mary logs into her HR system and assigns $500 of her bi-weekly paycheck to go to her grocery store account.

3. Cash loading

Customers can use multiple methods to load cash into their account. Depending on the card partner and technology selected for your co-branded debit card program, these can include ATM deposits and in-person at various locations. Cash loading is especially important for co-branded card holders who are underbanked or unbanked in the U.S

Alviere has three ways to enable our clients to offer cash loading as a funding method in their co-branded debit card programs:

- As a licensed money transmitter, our clients can accept cash deposits at their physical store locations.

- We partner with Visa ReadyLink to enable clients end-users to load cash into their accounts at all locations that participate in Visa ReadyLink.

- We partner with various ATM providers to to enable cash deposits at over 20,000 ATM locations around the U.S..

4. Card loading

Think of a debit card loading like a payment. With card loading, you can load funds by typing in card information. Because of its payment nature, card loading makes the funds available immediately (more about settlement times below).

One thing to note about card loading is that different types of cards have different costs. Debit cards are less expensive than credit cards, and costs vary more depending on the issuing bank and network of the card. More on funding method costs below.

5. Mobile check deposit

With a few photos and amount confirmation steps, customers can deposit their paper issued checks directly into their account through an in-app experience.

example: Sarah receives a claims payout and deposits the paper check she was issued. Mobile check deposit enables the entire check amount to be pushed into the account for easier spending.

Considerations: Costs and settlement times, and fraud

Offering a variety of funding methods for your co-branded debit card program is key to card usage and program retention. As you develop your program, and throughout the solution architecting process, there are two primary considerations with each type of funding method: Costs, settlement times, and fraud.

Different funding methods carry different costs, settlement times, and fraud. Methods like bank transfers and direct deposit methods typically carry the lowest cost and fraud risks, but also take one to three business days to settle. Card transfers and cash loading are typically more expensive, but settle immediately for instant spending. In terms of fraud, funding methods like mobile check deposit and card loading carry higher fraud rates.

Costs, settlement times, and fraud all have considerable customer experience implications and should be thoughtfully applied. As you develop the financial model for your program, you will be able to assess the applicable fees, risk, and expense and either absorb the cost, or push the costs onto your customers.

A way to overcome delayed settlement times is to pre-fund deposits. Pre-funding is widely used in card programs to create better customer experiences and make instant spending possible. Pre-funding requires the business to front the amount pre-settlement to ensure the end-user has immediate access. As you might imagine, pre-funding does require some cash requirements and a degree of risk.

At Alviere, we released our trusted funds release feature that allows our clients to set pre-funding controls at the customer, customer group, or method level. Alviere clients can pre-fund portions of, or entire deposits initiated by their customers.

“Quick access to funds is a key driver of spending and program retention for co-branded debit card programs. We created the trusted funds release feature to help our clients provide additional value to their end-customers by enabling them to pre-fund non-instant settlement methods of deposit."

- Martin Von Knobloch, Head of Product, Alviere

Here's an example of how trusted funds release works:

Let’s say Sarah has been a card holder for over a year and her deposit data shows that 100 percent of her bank transfers have been successful with sufficient funds in her sending bank account. Using historic deposit data, the business can make a decision that Sarah is good for her deposits, and set her account to pre-fund the entirety, or a portion of her deposits.

Offering a variety of funding methods is a crucial component to the success of a co-branded debit card program. As you develop the solution architecture and financial modeling for your card program, funding methods will play a critical role in the end-customer experience. If you would like to talk with an expert about funding methods, or other elements of a co-branded debit card program click here to contact us.