Nearly every airline and hotel offers a co-branded credit card to engage their guests & passengers, and incentivize them to return for their next trip. Entire websites and businesses operate by advising customers on ways to maximize travel rewards with cards playing a pivotal role to keep them loyal to a brand. Even recent reporting from CNN helped consumers understand the co-branded card landscape, including what options are often available for those with weaker credit profiles. We’re big proponents of what they suggest, namely leveraging credit responsibly as a tool to help reach larger financial goals, like building a stronger credit profile.

However, we know the reality is that some customers either may not want a hard inquiry on their credit file, know they’re unlikely to qualify, or have already applied for the co-branded credit card and been declined. How can brands meet their needs through financial products?

For airlines, hotels, and retailers, co-branded debit cards offer an alternative option to keep customers engaged in the brand rewards program. In this guide, we’ll walk through the similarities and differences between co-branded credit cards and co-branded debit cards, and how they complement each other to build a more expansive customer loyalty program.

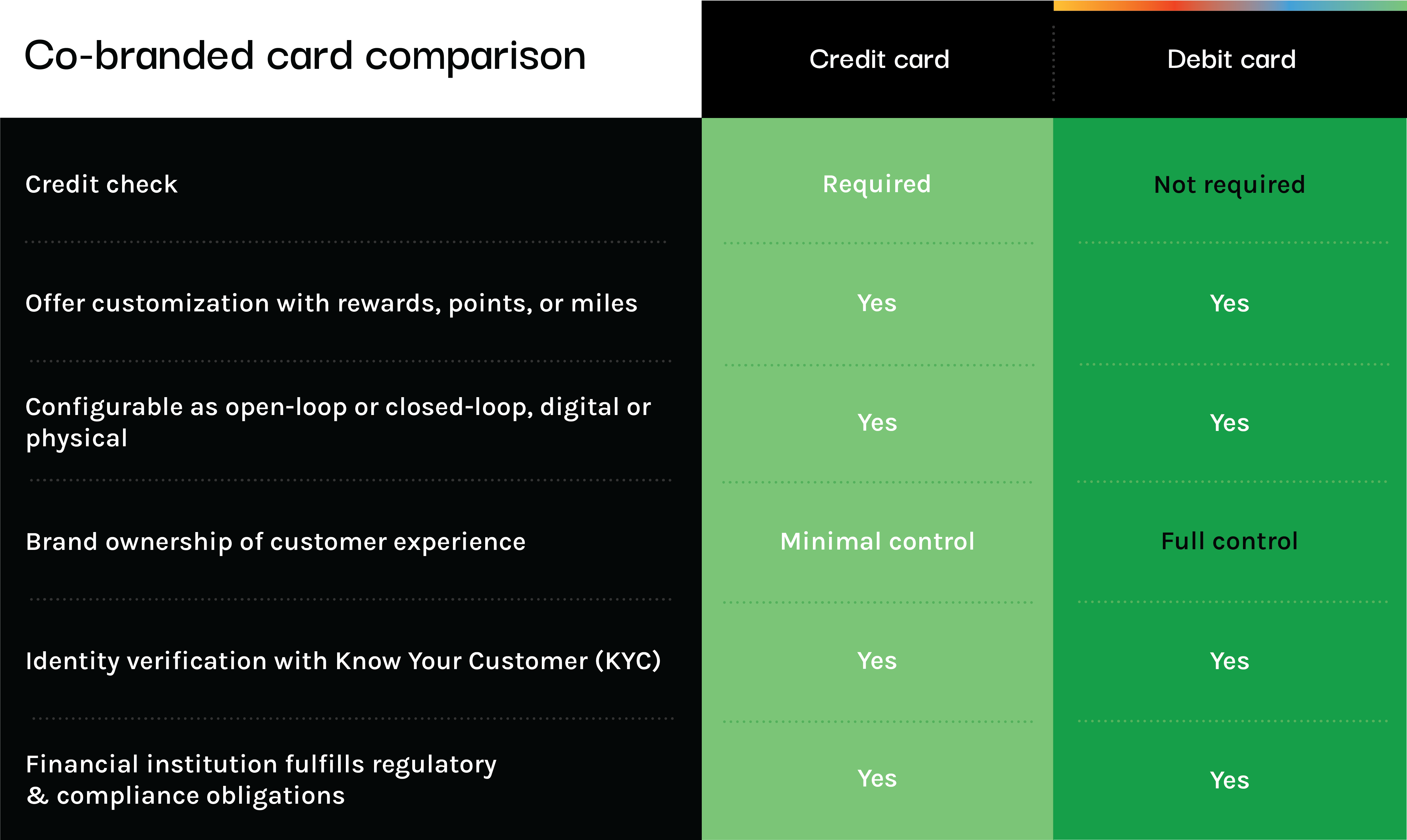

Here are important attributes of each card program:

Credit checks

There are significant differences between debit and credit cards when it comes to the approval process, specifically in evaluating an individual’s creditworthiness. For a co-branded credit card, an individual must authorize the financial institution to obtain credit bureau reports, employment, and income information. The Terms & Conditions may also allow the financial institution to obtain and use information from credit bureaus about accounts they have with other companies, like checking, investment, and utility accounts. Known most commonly as a “credit check” or “hard inquiry,” this is a strict requirement for co-branded credit card approval.

Alternatively, co-branded debit cards do not require a credit check. A debit option could be presented to customers after they apply for the co-branded credit card and are denied approval. Denial may be especially common among young consumers or individuals who’ve recently arrived in the United States, as they may have a thin credit file. The brand could instead offer a path for them to sign up for their debit rewards program and issue a co-branded debit card.

Loyalty offer customization

From the brand’s point of view, the role of any co-branded card program is two-fold: Increase customer loyalty and, ultimately, drive additional revenue for the company. A non-financial brand should advance its core business when offering a financial product. Cards are a powerful tool within a rewards program that’s designed to incentivize passengers, guests, or shoppers to choose the brand and spend more with it.

From the consumer side, co-branded credit cards are heralded by travel gurus like The Points Guy because they can help maximize a travel budget. It’s up to the issuing brand and bank to create a compelling offer with a combination of rewards, cashback, or points – which can be tailored with perks specific to the industry, like airport lounge access, miles, room upgrades, or early-access sale shopping. Plus, merchant-funded rewards can multiply those offers with incentives that are fully funded by a network of thousands of merchants. All of these same levers are available for either a co-branded credit or debit card.

Card configuration options

Both co-branded credit cards and co-branded debit cards can be issued in ways to bring value to both the issuing brand and the consumer. Choices abound for the brand to create a card program that meets their consumers and stays true to the core business objectives.

Co-branded cards can be open-loop, meaning they can be used at any merchant that accepts payments through a major card network, like Mastercard or Visa. Often, a consumer will be incentivized with more points or rewards for purchases made with the brand that is associated with the card.

Co-branded cards can also be closed-loop, where they’re merchant-restricted. For example, a department store could limit its co-branded credit card to be used only for purchases in their store. However, this is not as common as open-loop. Co-branded cards tend to be open-loop because this provides the opportunity for the card issuers to earn interchange revenue wherever the customer shops, making a stronger business case for the program.

Debit and credit cards can be issued as virtual or physical cards, providing options for the issuing brand and bank to determine the most compelling offer to drive the desired purchase behavior. The subject matter experts at Alviere recently sat down to record this Webinar: Keys to a modern card program, outlining the potential areas that brands could configure in their card programs and weighing the tradeoffs of each option.

Brand ownership

One of the most valuable assets for any company is the equity it has built in its brand. Despite all the research that’s readily available, consumers may make decisions based on sentimentality or gut feeling over the rational – where brand affinity can win the sale. This makes it critical to control the entire customer experience, including when customers use a co-branded card. In its recent report, Harnessing the Power of Embedded Finance, KPMG calls this “removing the friction,” noting that brands can exercise greater control and influence over customer experience (CX) as a result of partnering with an embedded finance platform to tailor the CX to their business requirements. It’s a clear area where co-branded debit cards offered through an embedded finance provider have an advantage over traditional co-branded credit cards from a bank. For example, most airlines entice customers to co-branded credit cards on their own websites or apps, then send the user to a bank website to apply. With embedded finance, the customer stays within the brand experience without being sent to a third party domain.

Identity verification

Anytime a customer signs up for a new financial product from a reputable brand, their identity will need to be verified. This requirement dates back to the U.S. Bank Secrecy Act (BSA) that was originally drafted in 1970 to prevent money laundering. The process of verifying a user’s identity is known as Know Your Customer (KYC) due diligence. For both co-branded debit cards and co-branded credit cards, the issuing financial institution will perform KYC using information like full name, address, and date of birth. Depending on how the brand and financial institution designed the overall co-branded card program, a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) may be required.

Role of the financial institution

With co-branded credit cards, the bank manages all aspects of financial compliance, including underwriting the credit that will be extended to the consumer, managing user agreements, and providing customer support throughout the relationship.

With co-branded debit cards, there’s no credit extended to the customer. Instead, the individual funds the co-branded debit card with their paycheck, cash deposits, or by transferring money from an existing checking account. Funds must be settled in the card’s account before the customer can use it, so there is minimal risk to the issuing entity that a lengthy collections process could take place, as can happen with credit cards.

The financial institution behind either type of co-branded card program is likely to manage all facets of financial compliance, risk, and fraud on behalf of the brand. This can also include P&L ownership, implementation.

In this article, Is the plane flying half empty? Why airlines need co-branded debit cards, there’s a reason that the big banks in the U.S. are not keen to work with brands to offer co-branded debit cards: With the passing of the Dodd-Frank Act, banks can’t earn as much money from co-branded debit cards as they did before the 2008 financial crisis. This has left a gap in the market, where there continues to be opportunity and demand for co-branded debit card products, but with few financial institutions willing to work with brands to supply them.

Alviere is one such financial institution that works with Travel & Hospitality or Retail brands to launch Co-branded Debit Cards while tackling the significant undertaking to manage the program, leveraging the existing rewards or co-branded credit card offers. We still believe these businesses have an opportunity to build on their foundational loyalty programs, including co-branded credit cards, to serve all customer segments with a debit option.