Embedded finance technology capitalizes on the most important asset an organization has: Its customer base. Taking advantage of consumer demand for always-on access to financial tools and the natural frequency of interactions, enterprises can more deeply engage their customers by offering products and services from the companies they already trust.

The recent explosion in embedded finance has been fueled in part because, unlike other growth strategies, it’s low cost and the returns are immediate, yet sustainable, because scalability is limited only by the consumer's needs.

Discover seven proven business growth strategies and learn how embedded finance aligns with — and powers — them.

1. Drive new vertical integrations

Companies are looking for effective ways to break into new markets. It’s no longer the case that enterprises focus solely on their core competencies as a market penetration strategy. Large firms are expanding their product offerings and improving the customer experience whether it’s through vertical integration, horizontal integration, or other means.

Embedded finance is disrupting traditional vertical and horizontal integration models because it allows companies to enter a completely new sector. Non-financial companies are crossing over into fintech (financial technology) territory. Embedded finance refers to the integration of traditional financial services with a non-financial enterprise’s app or website. For example, Nike offers branded banking services and embedded payment solutions. As large non-financial enterprises look to partner with solutions providers to offer financial services directly to their customers, they see results like increased revenue and customer lifetime value.

2. Improve customer experience

In a recent study, 57 percent of business leaders viewed improving the customer experience as an essential growth strategy. Harvard Business Review found that a 5 percent increase in customer retention can lead to a 25-95 percent increase in profits. Walmart, the world’s largest omni-channel retailer, offers extensive banking services, like money transfers, debit and credit cards, bill payer services, and in-house check cashing to its customers. The retail giant hired two executives from Goldman Sachs to lead its new finance division, underscoring its emphasis on financial services for growth. Large enterprises are often the first movers, but embedded finance is approachable for any organization.

3. Market disruption

Technology is a critical enabler of disruption, fueling new access and capabilities into existing markets. With fintech powering direct access to financial products, consumers quickly became attuned to convenient banking services through a mobile app or website. Taking a page from existing loyalty programs, X-Wrist, a smart fitness watch similar to the Apple Watch, incorporates payment functionality with its rewards program. Wearers are rewarded with Energy Value Tokens for their fitness efforts, and they can use the wearable to make purchases through an embedded payment solution. By complementing existing products and services with instant in-app payments, reward programs, and more, a company becomes more appealing to potential and existing customers.

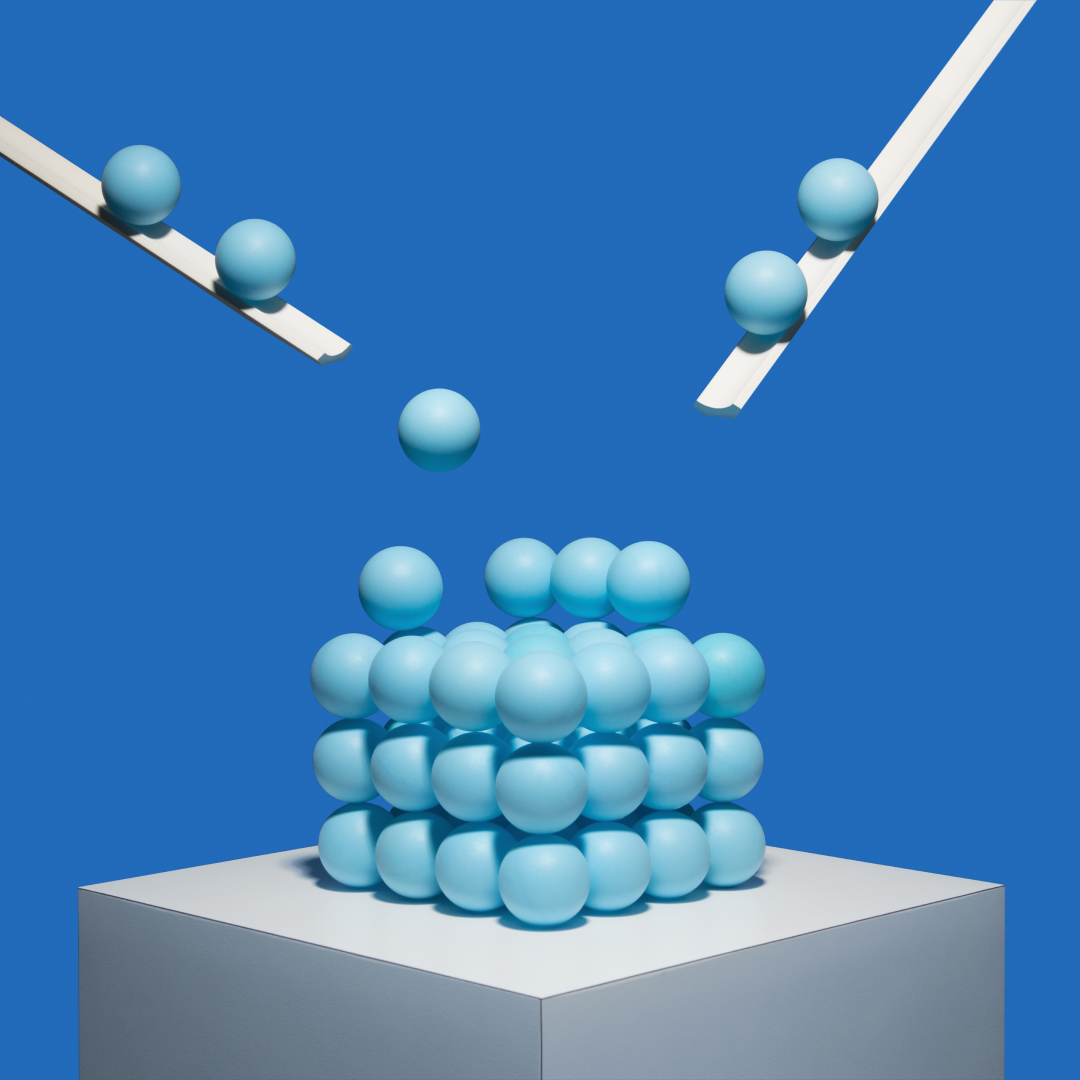

4. Incrementally build breadth and scale

An embedded finance provider offering a modular approach makes it possible to add just one service at a time. For example, a company might start with banking services and add a promotional gift card program later. It might further add global money transfers as it expands into new markets across geographies.

Using a single embedded finance provider across all capabilities assures security and compliance consistency, versus working across multiple vendors. Each integrated solution, such as branded cards, provides an opportunity to learn more because they increase the number of customer touchpoints.

The additional data from these touchpoints combined with innovative financial solutions, such as machine learning and predictive analytics, forms the blueprint for a hyper-personalized customer acquisition strategy.

5. Product expansion or diversification

Developing new product lines or adding new features to existing ones creates new revenue streams. But developing the right products can be costly both in financial investment and time. Embedding banking and finance products are already proven and necessary, so there are no costs for R&D, new product development, or market research. For example, diversification for home improvement giants Lowe’s and Home Depot could include offering point-of-service insurance for its high-priced power tools sold in-store or online.

6. Channel expansion

Embedded finance products bring the customer closer and provide data that can be analyzed to better understand their needs. Data on use, purchase patterns, and customer preferences drive decisions on new channels. A case in point: While customers love convenient mobile apps for their banking, Walmart has opened MoneyCenters in some of its brick-and-mortar locations for those who would rather transfer money, cash checks, or pay bills in person.

7. Operational efficiency

Examining all processes and money flows can lead to “found money” by removing traditional bank fees and time involved in processing and making payments. For example, a large global company can leverage embedded finance for international salary payments. Without using a bank to make payments, funds can be sent and received faster with less friction.

Partnering with an embedded finance provider builds financial products into a non-financial company's existing platform. The embedded finance provider introduces the tech stack and provides the regulatory oversight to facilitate financial activities. This elegant partnership can power enterprise growth strategies in the near-term and for long-term sustainability.