Amazon first started as an online bookseller founded by Jeff Bezos in July 1995, selling and shipping physical books to anyone with internet access at the time. In the first month of its launch, Amazon sold books to people in all 50 states and across 45 countries. By the end of the following year, the brand had racked up $15.7 million in revenues, and by 1997 the company went public with an IPO that raised $54 million. The company soon expanded its reach beyond books and, by 1998, had branched into selling electronics, toys, CDs, and home improvement tools. By the early 2000s, Amazon introduced a service allowing individual sellers and third-party merchants to sell their products alongside Amazon’s platform. This integration of third-party merchants became an ultimate game changer for the future of Amazon’s business operations, eventually fueling its triumphant takeover of the retail and e-commerce industry.

From humble beginnings inside Bezo’s garage, Amazon soon became one of the world’s largest online retailers for all consumer products, with explosive growth in the e-commerce and tech industry in the following years. This diversification of Amazon’s revenue streams has been key to the brand becoming a corporate powerhouse that spans multiple industries. This is credited to their competitive customer loyalty program, vast tech ventures, and embedded digital banking services.

Amazon's mission to stay fully connected to customers, increase engagement, and provide seamless customer experiences has set the brand well ahead of its competitors for the foreseeable future. A primary component of Amazon’s success is its ability to increase engagement by placing customer experiences first, a journey worth highlighting since the brand is now one of only four companies to surpass $1 trillion in market cap. Unafraid to explore new markets, Amazon has five primary divisions: Amazon.com, AWS, Alexa, Whole Foods Market, and Amazon Prime. Today, more than 1.7 million small- and medium-sized businesses worldwide sell in Amazon's stores, drawing over 300+ million customers with active accounts in over 180 countries.

Raising the bar with Amazon Prime

With the ingenious introduction of the Amazon Prime customer loyalty program in 2005 came a remarkable rise in customer appreciation, engagement, retention, and loyalty for the Amazon brand. Currently, prime memberships are available in 23 countries. The $14.99 monthly subscription includes benefits like free two-day delivery of eligible items, Prime Video, Amazon Prime Music streaming, free gaming, free grocery pick-up at Whole Foods, free ebooks, and the recent addition of a free year of Grubhub+. This move to reward customers for constant engagement has catapulted customer lifetime value for Amazon’s business. The brand reeled in $25.21 Billion in annual revenue from retail subscription fees, acquiring 200 Million active Prime members with the incentive to easily shop, pay, and indulge in entertainment all in one place.

As a perk exclusive to Prime membership, Amazon offers its customer base a wide array of co-branded card products. These cardholders are more likely to spend more with Amazon, increasing marketplace sales, boosting customer loyalty, and attracting new members with cash-back rewards and brand partnership discounts and benefits.

Amazon card partnerships:

Amazon Prime Store Card - Launched with Synchrony Bank in 2015, this was Amazon’s first card exclusively for Prime customers, offering unlimited 5 percent cash back on Amazon purchases.

Amazon Store Card - This is the standard version of their original card for non-Prime customers. It does not offer the 5 percent cash back perk or as many benefits as the Amazon Prime Store Card.

Amazon Reload - This reloadable digital debit card is available only to Prime members and offers 2 percent cash back on Amazon purchases. The card links directly to a customer’s checking account and reloads on a recurring or one-time basis.

Both versions of the Amazon Store Card are closed-loop, which means the cards can only be used at Amazon.com, Amazon-owned businesses, including Audible, Amazon Bookstore, Amazon Web Services, and places that accept Amazon Pay. The brand soon extended its financial service offerings again with an open-loop card partnership with Visa to launch a rewards debit card to be used anywhere for both Prime and non-Prime members.

Amazon Prime Rewards Visa Signature Card — Launched in partnership with Chase in 2017, this card gives Prime members 5 percent cash back at Amazon and Whole Foods, 2% cash back at gas stations, restaurants, and drugstores, and 1% cash back on everything else.

Amazon Rewards Visa Signature Card — This is the standard version of their rewards card for non-Prime customers. It offers 3 percent cash back on Amazon and Whole Foods purchases, 2 percent cash back at gas stations, restaurants, and drugstores, and 1 percent cash back on everything else.

Amazon Prime continues to pave the way for premium card loyalty programs, building an ecosystem that’s increasingly valuable to its members, along with the option for new customers to join via a free trial with their first purchase. This feature allows customers to take advantage of the benefits that interest them most immediately, and this incentive keeps them continually interacting with Amazon's products and services.

Through Amazon Personalize introduced in 2018, the brand leverages machine learning and predictive data analytics with API technology to give every customer personalized recommendations for their shopping experience each time they visit the platform. As a powerful customer engagement tool that creates personalized recommendations as customers browse and shop on the platform in real time, it includes specified product recommendations, impressions data, customized direct marketing, and personalized product ranking across Amazon’s retail, entertainment, and media sectors in each customer's Amazon account.

These real-time analytics help Amazon understand what behaviors drive their high-value customers as they continually optimize the retail experience, adjusting to customers whose wants and needs will shift over time. The utilization of machine learning allows Amazon’s value proposition to expand as its business grows, maintaining the relevancy of the platform into the future.

The entirety of the shopping experience extends customer-lifetime value from targeted attraction marketing to completion of the transaction and fufillment as Amazon hones in on optimizing convenience, and supporting financial flexibility through the multitude of available payment options. Whether it’s a timely video across the platform or a personalized email delivery just at the right moment, personalized experiences, based on live customer data, delivers more relevant experiences for customers and in return yields higher business returns as the platform automatically improves recommendations after each visit.

Amazon has built a brand experience that remains front and center, and as customers' lifestyles change, the benefits of Amazon Prime will also evolve. Amazon Prime solidifies customer lifetime value with personalized user experiences that are highly targeted, resourceful, and always relevant for customers as they shift and move forward in life.

Tech domination with Amazon Web Services (AWS)

Amazon Web Services (AWS), launched in 2006, is a comprehensive, evolving cloud computing platform provided by Amazon that includes infrastructure as a service (IaaS), platform as a service (PaaS), and packaged software as a service (SaaS) offerings. Amazon Web Services is one of the first cloud services to introduce a pay-as-you-go cloud computing model. This program provides more than 100 services that include customer data analytics, database and infrastructure management, application development, artificial intelligence, security, financial services, and more.

The AWS financial sector empowers other organizations to modernize the financial services behind their business infrastructure. This service enables brands to meet their rapidly changing customer behaviors and expectations and drive business growth through embedded banking, payments, capital markets, and insurance products. Amazon leveraging embedded finance to enable financial services for other companies has generated revenues of $62.2 Billion in 2021. Amazon quickly realized having an omnichannel presence was a critical competitive differentiator for business growth and expansion.

Amazon’s utilization of embedded financial services not only for their platform but as a service to other businesses takes the ability to up-sell and cross-sell products and services to new heights. This technology is predicated on a deep ongoing relationship with customer data and the ability to allow businesses to capture their own first-party customer spending data. These troves of invaluable data can easily translate into increased engagement, higher retention, lower customer acquisition costs, improved sales productivity, and strategic marketing expansion.

The pinnacle of convenience with Amazon Pay

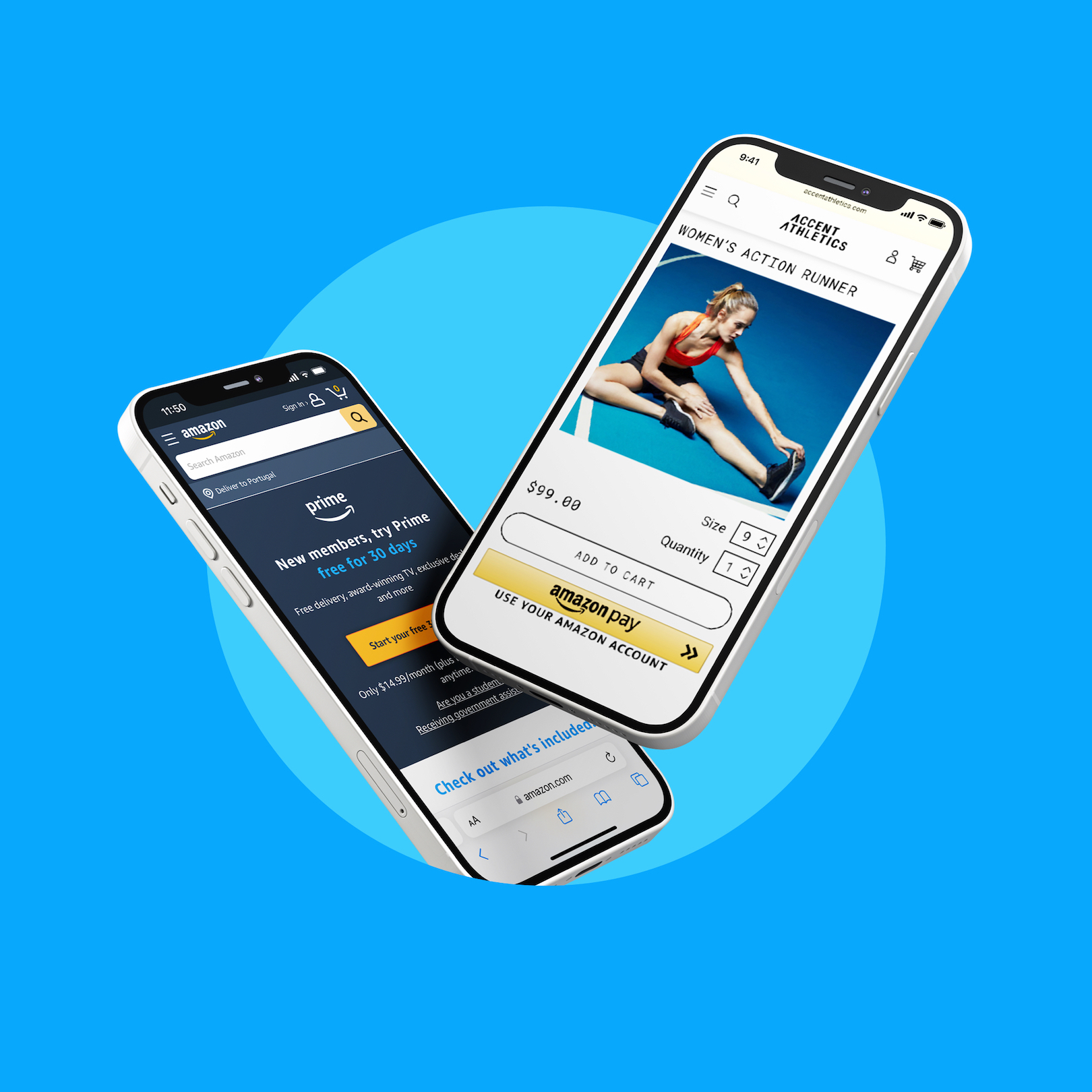

Amazon’s first known payment product, Amazon Pay, was launched in 2007. Amazon Pay is an online payment processing service that allows customers to pay with their Amazon accounts on partnering external merchant websites. Well ahead of its time, Amazon Pay utilizes embedded financial technology to focus on reducing payment friction and improving user experiences for both its customers and merchants.

Since Amazon Pay is not exclusive to Amazon's platform, any retailer using Amazon Pay Services can integrate financial services into their business, customers are granted the safety, speed, security, and convenience of their payment methods. Amazon Pay features multi-currency support, allowing international customers to avoid currency conversion fees from their credit card issuer or bank, payment protection for merchants, and recurring payments support. Merchants using Amazon Pay incur no transaction fees, membership fees, or foreign transaction fees, a competitive advantage that is crystal clear for the Amazon business model.

Providing digital wallets for customers, one-click payment options, and installment plans, like buy now pay later, is just the tip of the iceberg for Amazon’s financial service offerings. In addition, the company offers credit lines, gift card services, and stored fund accounts so customers can keep and manage their payment methods directly through Amazon’s platform. Customers can also shop with other businesses and are given the option to skip entering their credit card information each time they complete a purchase. By powering payments for other merchants, they have saved their customers the hassle of creating new accounts and passwords for a one-time purchase.

Amazon Pay has ultimately evolved into a payments network for merchants while, in the same breath, pushing customer satisfaction forward and further streamlining the digital shopping and payment experience. The service has grown into a major online payment provider with a 24% user share in the US. And recently, payments made with Amazon Pay spiked following service expansion to new geographies — France, Italy, and Spain — and into new verticals, including government payments, travel, insurance, entertainment, and charitable donations.

Amazon introduces better business financing

Amazon is no stranger to looking for new growth opportunities, especially regarding its financial service offerings. Amazon Lending was launched in 2011 to provide small businesses with easier access to financing solutions in the U.S. The program includes term loans, business lines of credit, and interest-only loans for qualifying merchants. By 2018, Amazon Lending partnered with Bank of America Merrill Lynch to issue loans ranging from $1,000 to $750,000 for borrowers. But in 2019, the company shifted gears to partner with Goldman Sachs and offer credit lines up to $1M, including a digital application process and instant approval notification. Although this program is invite-only, Amazon’s Lending is available in the US, UK, Germany, Canada, China, France, India, Italy, and Spain. Amazon’s efforts to build a portfolio of financing tools for their merchants' business needs didn’t stop here. By 2020, Amazon had invested more than $18 billion in the success of its third-party selling partners, including tools, services, programs, infrastructure, and people.

Since Amazon already offered financing opportunities for small and medium businesses, it was an easy shift to do the same for individual consumers by launching the Amazon Prime Secured Card in 2019. This initiative by the e-commerce giant acts to solve one of the biggest barriers to shopping on its website: lack of a credit card. More than a quarter of U.S. households have no or limited access to checking and savings accounts. These unbanked and underbanked households rely heavily cash or checks to fund purchases, creating a barrier to seamlessly shopping online.

Through a partnership with Synchrony Bank targeting the unbanked and underbanked populations, Amazon marketed this closed-loop card to customers with bad or no credit history. The card program includes receipt of a digital and physical card, an initial security deposit between $100 to $1,000 at the customer's choice, has no annual fee, and offers Prime members 5% cashback on Amazon.com purchases. This secured card program also includes credit builder and tracking tools. The initial deposit determines customer credit limits as Synchrony Bank reports payment history to all three credit bureaus to improve customers’ credit scores through card usage.

With this service, Amazon has nailed weaving rewards programs and incentives into essential financial products and services that underbanked customers can more easily access and utilize. Beyond this, Amazon is providing financial resources and opportunities to a financial class of both customers and small businesses who are essentially left behind when it comes to qualifying for credit card services or financing through traditional banks. Amazon continues to spearhead financial digital inclusion for customers who may have been previously unable to take part in the digital economy, leaving no stone unturned for new customer acquisition, improving customer loyalty and increasing customer lifetime value.

Prime benefits beyond Amazon

Buy with Prime is a newer service launched in April 2022. It allows Prime members to order items through other retailers’ websites using payment and shipping information stored on their Amazon account with a one-click purchase capability. This service also enables free delivery, a seamless checkout experience, and free returns on eligible orders backed by Fulfillment by Amazon (FBA). As this new incentive attracts more customers, it also empowers other companies to promote the Amazon brand while scaling their businesses at lower costs.

Amazon brand loyalty is further extended into new markets as this program completely shifts the utility of the Amazon Prime membership. Buy with Prime sets a new standard for customer convenience, elevating the online shopping experience via a multichannel proposition that benefits Amazon, the merchants, and, most importantly, their customers.

Amazon's mission to be “Earth’s most customer-centric company” is a vision that has successfully come to fruition. The brand's global reach in e-commerce, financial technology, and customer loyalty has reimagined the digital shopping experience. While Amazon continues to raise the bar on the competition and maximize its success, it’s evident that embedded financial services have played a significant role in the evolution and growth of the Amazon empire.

What's next? Possibilities for Amazon

Amazon has pursued digital payments innovation time and time again as the brand supports its customers' financial needs directly through its platform. We just explored all the financial service offerings Amazon has to offer, and they leave nothing on the table except for one thing. Their customers are already using Amazon's digital wallets, Amazon visas and secured cards, Amazon financing and loans, Amazon Pay to store their private bank information, and more. So why hasn’t Amazon just become its own bank?

With the mastery of customer personalization through Amazon Prime and Personalize, the financial versatility behind Buy with Prime and Amazon Pay, and Amazon Lending and Credit connecting with undertapped consumer markets, the company has all the working parts of a bank, including the capital to support further expansion of its financial operations.

Currently Amazon is still outsourcing financial services through traditional banking institutions and co-branded card partnerships. To manage any card or financial line of service offered through Amazon, customers still have to go directly through the issuing bank for questions, concerns, or issues, causing significant disruption in streamlining the customer experience. This also means Amazon is sacrificing valuable first-party data and insights from card usage to customer spending behavior outside of their platform and cannot fully capitalize on interchange revenue because that is still being collected by the bank.

With the right embedded finance partner, Amazon could directly own, automate, and fully control all of its financial service offerings from delivering their own branded cards, and virtual accounts to lending and instant global remittances. Amazon wouldn’t need to be co-sponsored by any bank and be held captive within a bank's restrictive rules and regulations on consumer qualifications for financing, credit, and lending. The brand could create their own baseline for qualifying customers, and by becoming their own banking entity would bring customer experiences with their financial services full circle.

Customers could use the Amazon platform for everything from shopping, and entertainment to a full-service banking platform with customized banking solutions for each customer. Amazon customers could send and receive money across the globe on the same platform where they shop and order delivery. Amazon could become the largest customer-centric retail bank the world has ever seen with the full implementation of an embedded financial platform.