A century ago, layaway became an option for consumers who wanted to buy an item, but lacked the cash to do so. They would make installment payments until the item was fully paid for, then collect the item. With the advent of credit in the 1970s, layaway became a relic of the past, as consumers were willing to pay interest to get items immediately.

Today’s purchase journey has evolved drastically with the emergence of Buy Now, Pay Later (BNPL) solutions that offer consumers short-term financing at the point of purchase through their favorite e-commerce retailer sites. However, personal finance experts at NerdWallet only recommend using a BNPL plan for necessary purchases “like a mattress for your apartment or a computer for school” because it’s still a form of debt. For consumers who are wary of taking on additional debt or do not qualify for traditional credit cards, the layaway concept is newly relevant.

The time is right for Save Now, Buy Later

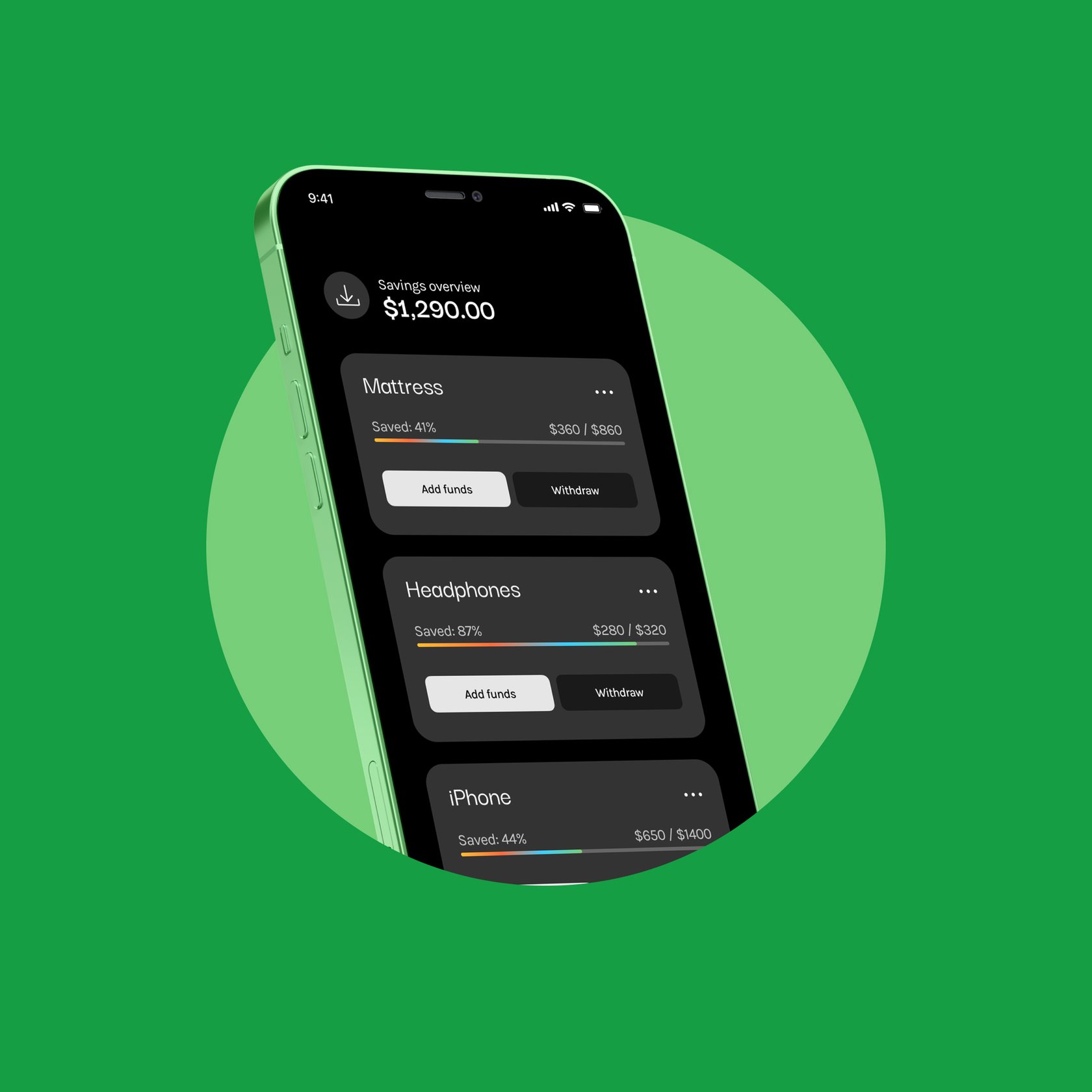

Enter the age of Save Now, Buy Later (SNBL) through Recurring Deposits & Savings. These new layaway programs allow incremental savings towards a large purchase, with no interest or penalties for early withdrawal. What’s different from layaway is that Save Now, Buy Later programs are now run digitally, and merchants can provide incentives to buyers to reward or accelerate their savings toward the purchase. Plus, customers can automate deposits within their allotted budget. Also, Save Now, Buy Later (SNBL) solutions can be completely white-label and embedded into an existing platform, rather than introducing the consumer to a third-party brand and experience.

Advantages for the consumer

- Affords a realistic avenue to purchases that might not normally be possible without taking on debt. Large screen TVs, vacations, and collectibles now become possible, with a clear path to ownership that doesn’t require a credit check.

- Allows for reasonable payments over an amount of time determined by the consumer. Saving for a perfect wedding can start two years before the event, with steady contributions made each month.

- Avoids impulse purchases. Delayed gratification and extended payment runways lead to lower regret purchases. Large purchases are now considered, with thoughtful, ongoing investment.

Advantages for the business

- Assures predictable revenue. Customers lock in their purchases, and continually contribute to the deposits, which can earn yield along the way for the enterprise.

- Enables better inventory management. Companies obtain visibility into future purchases by owning the deposit accounts that customers are using to save up.

- Accelerates consumer contributions. Enterprises can offer meaningful rewards towards purchases through discounts or additional incentives for early goal achievement.

- Adds ongoing meaningful engagement to existing loyalty and consumer apps. Consumers log in to check balances frequently, and can see offers for their planned purchase or the next one.

Everything old is new again, but the context is different. Buyers now can opt to save for larger purchases without strings attached, and businesses can lock in customers without barriers to purchase. Save Now, Buy Later is the path forward for considered purchases with less friction for both buyers and sellers.