(Originally published August 25, 2022, updated April 6, 2024)

In early 2008, Starbucks hit a wall after a period of rapid over expansion. In-store sales were on the decline and this soon led to the closing of over 600 stores across the U.S. After the stock market crash in October of that year, the economy took a turn for the worse. As customers began to cut spending, Starbucks took a major leap toward recovery by launching a new loyalty program. This mobile app coupled rewards with gift card services, social media strategy, and emerging financial technology to create one of the most influential customer loyalty programs recognized today.

With a complete turnaround, Starbucks has now served more than 100 million customers across 78 markets around the world. By 2021 Starbucks had the largest mobile payment user base in the United States with 31.2 million active users. How Starbucks got here is an incredible journey focused on creating the best customer experiences possible by developing a new era of customer engagement, digital personalization, and dynamic rewards and incentives.

Going digital with "My Starbucks Idea"

Under the guidance of its infamous CEO Howard Schultz, Starbucks set out to differentiate the company through new technology and the internet early on. Schultz launched the platform My Starbucks Idea in March 2008, which was a co-collaborative online space for Starbucks to proactively collect customer ideas and feedback on beverages, food options, business operations, rewards, and perks.

Customers could create profiles, vote or comment on other people's ideas, and interact with an entire community of coffee lovers all in one place. Ahead of its time with its own version of basically a Coffee Facebook, the My Starbucks Idea platform was pivotal for product and services advancement, customer engagement, brand identity, and brand loyalty.

As inspiration constantly flowed from customers' wants, needs, and interests directly into the company for over eight years, a lot of the most popular ideas are still being successfully implemented today after becoming synonymous with some of Starbucks' most popular features as a brand:

- Free Wifi in stores

- Free birthday treats

- No receipts for purchases under $25 to save paper

- Online gifting of beverages between friends

- Collaborating with Keurig to create K-Cups

- Sell cake pops

- Introduction of a rewards system

The My Starbucks Idea platform was the perfect segue into enhancing customer experiences both online and in-stores. By 2009 Starbucks launched its mobile app for the first time, and the My Starbucks Rewards program was officially born.

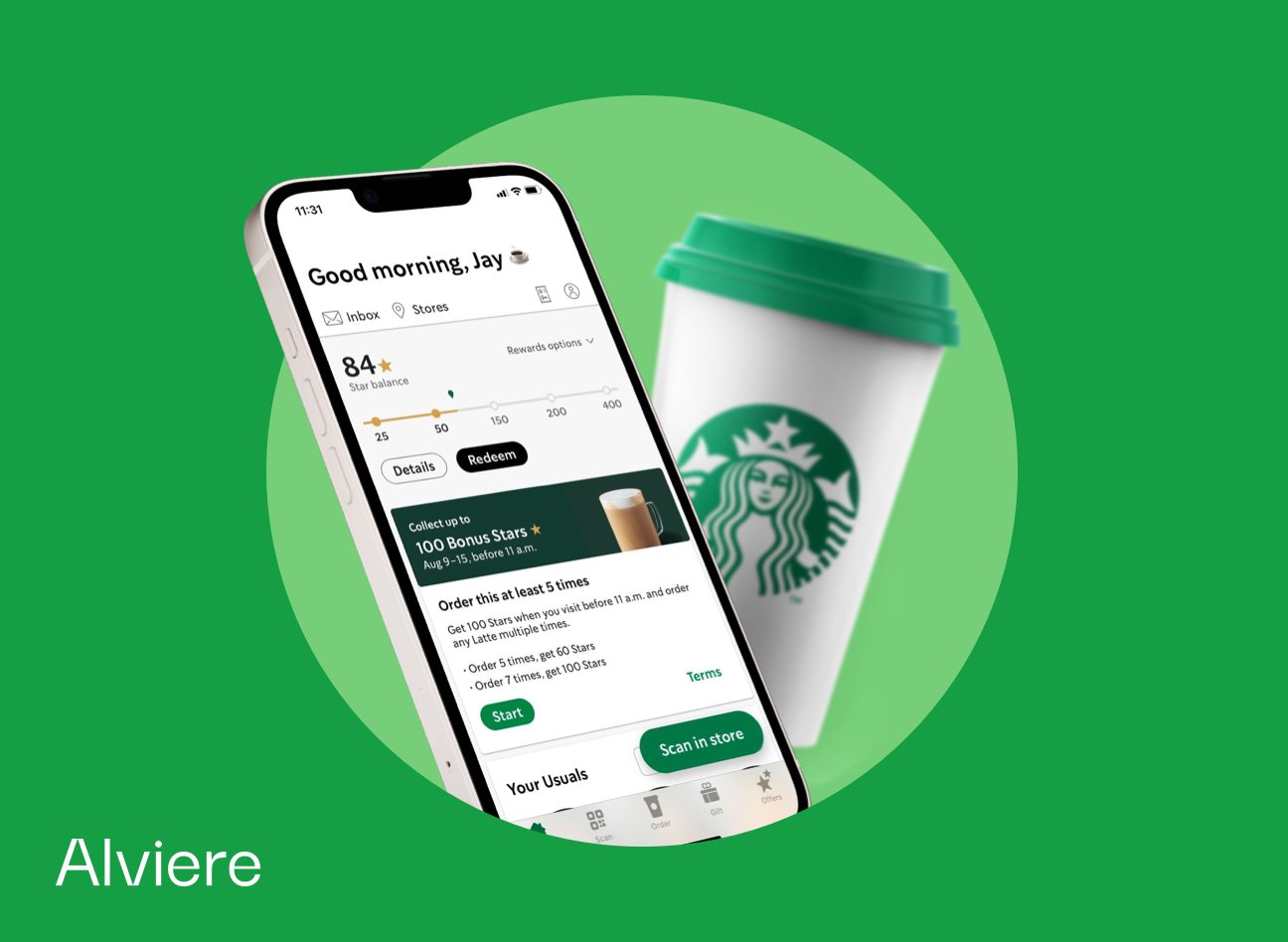

The program that awards Starbucks customers with "stars" to be redeemed for perks like free coffee, bakery items, and branded merchandise now boasts over 32 million members. Starbucks Rewards represents 57 percent of total revenue, meaning more than half of Starbucks sales are generated directly from rewards customers.

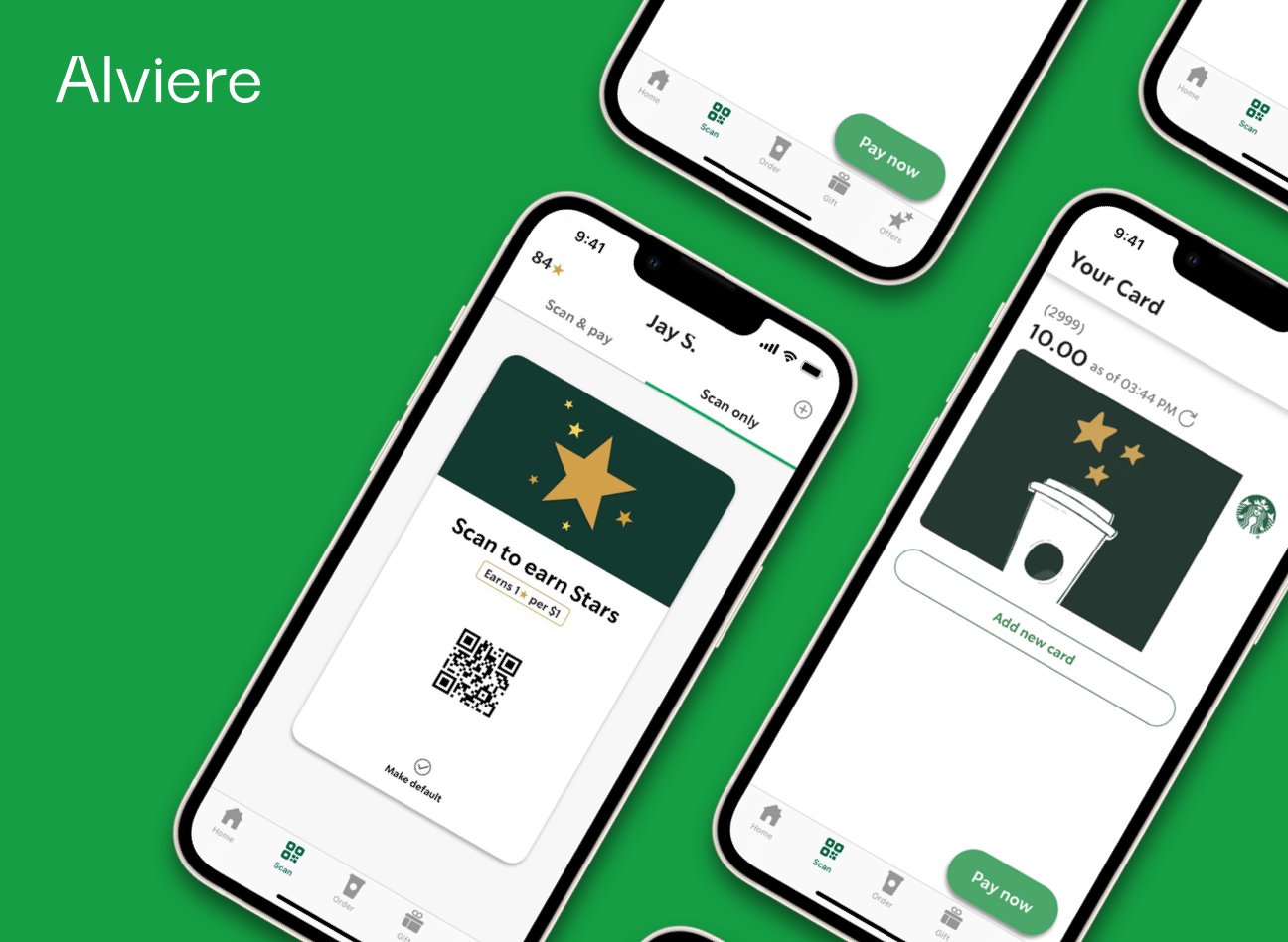

Starbucks began offering in-app mobile payments by 2011, eventually including the rollout of mobile pre-orders by 2014, and curbside pickup by 2020. With one star rewarded for every $1 spent, pay-as-you-go customers, and 2 stars rewarded per $1 spent for customers who preload funds on gift cards or in-app, these simple incentives increased spending per customer, improved retention rates, and upgraded engagement and marketing efficiency.

Starbucks customers now had a central hub of information about menus, store locations, and opening hours that also covered all the main functions any customer would need on the go including browsing the menu, ordering, paying, pickup, and personalized rewards.

Deep Brew: AI intel + coffee machines

Taking business a step further, Starbucks launched Deep Brew in 2019, an AI-driven platform to keep pace with the fast-moving market changes and to collect data on customer behavioral patterns. In 2020, Starbucks generated $19.16 billion in revenue. That’s double the revenue after implementing AI into its mobile apps.

Deep Brew is the fuel behind Starbucks’ delivery of highly personalized recommendations to every customer. Not only has Starbucks mastered creating individualized offers at an enterprise scale, but its platform creates millions of offers each week with dynamic actions and rewards that influence customer behaviors for cross-selling and upselling opportunities every day. Deep Brew also enables continuous learning over time, tracking customers’ historical data and interaction patterns to optimize individualization the more they use the app.

The coffee giant's loyalty program deploys customized offers through omnichannel marketing covering mobile app alerts, emails, and push notifications. In addition to these enhanced connections to customers, Starbucks is also able to directly measure the impact of its initiatives by gathering key performance indicators that strengthen and feed into the next promotional campaign. This data is also used to plan where to open new stores. Starbucks' Deep Brew AI creates revenue projections based on unique demographic and location data and this helps determine where the next big revenue opportunities can be uncovered worldwide.

The company can easily push tailor-made recommendations according to the time of day and frequency with which customers usually visit their particular store location. By sending real-time push notifications, they create a deeper level of connection with customers and in turn, customers notice that Starbucks takes their preferences into account.

Capitalizing on behavioral and geographical segmentation Starbucks can take advantage of sales opportunities connected to repeated behavioral patterns on the customer level.

Customer-centric rewards paired with coffee

Starbucks has full visibility into customer profiles. The company can view whether customers prefer mobile ordering, their repeated food or beverage preferences, the amount of their average order, how frequently they're visiting, how stars are being redeemed, and even what location customers frequently visit. This is a critical driver behind customer retention and customer lifetime value (CLV), as the Starbucks app can automate offers with dynamic actions and rewards to influence certain customer behaviors including purchase frequency, product category exploration, and pushing cross-sell and upsell opportunities of new products.

Starbucks' early use of embedded financial technology is why Starbucks is at the forefront of excellent customer experiences, a leader in customer loyalty, and a pioneer of digital personalization. Today, Starbucks is essentially its own neobank and tech company.

How Starbucks uses financial services to keep customers coming back to its stores

Starbucks has implemented closed loop cards, which are stored value cards, and can only be used to make purchases from Starbucks. Starbucks customers preload their virtual wallets and gift cards with the incentive to earn double the rewards for spending all while Starbucks avoids costly transaction fees.

These preloaded funds act as a source of free lending without the company paying interest. Stored card values for Starbucks act as bank deposits and have fewer regulatory requirements since they can’t be redeemed for cash and aren’t insured.

These deposits are recorded as a liability for Starbucks and in doing so the brand can use these funds for business as they see fit.

Starbucks is outpacing big banks

In addition to facilitating and processing purchases, Starbucks also stores an incredible amount of customer funds every year. Remember that customers receive double the stars as reward points if they preload money into their Starbucks account, an incentive that is not a coincidental move.

Starbucks customers have accumulated a total unspent balance of US$1.6 billion on the company's prepaid cards. Benefiting from the interest these funds generate, Starbucks also gains $118 million in revenue from unused gift cards and loyalty credits. This means Starbucks keeps all preloaded funds that go unused or unspent over time.

To put Starbucks' $1B+ in stored value in context, consider that 85 percent of U.S. banks have less than $1B in assets.

In recent years, digital banking services have graduated from a niche product offering to a mainstream business trend as the opportunity to create better customer experiences has motivated large brands like Starbucks to recognize that the future of retail is tied to embedded financial technology. Technology that not only powers personalization at scale but deepens customer relationships, solidifies brand loyalty and strengthens customer lifetime value.

Starbucks has created a streamlined customer experience that raises the convenience of the checkout process, all while offering consumers the ability to bank funds for their next purchase. Through the application of data insights and optimization of customer data and insights, Starbucks easily paces ahead of its competitors as the app anticipates the needs of each customer and gets better at doing so each time it’s used.

Starbucks exemplifies everything embedded finance brings to the table for an enterprise organization. Its smart use of financial products showcases how a robust customer rewards and loyalty program can benefit both customers and the company for the long haul.

What Starbucks could do next

There's no doubt that Starbucks paved the way for the world's top brands to see the vision of what embedded finance could offer. With that said, there's always an opportunity to evolve. A natural progression for Starbucks' card program could be to offer open-loop cards.

Open-loop cards offer consumers to use a Starbucks branded debit card for any purchase, from everyday essentials or splurges, all earning stars for their expenditures. Starbucks customers would load funds into the debit card for these purchases. This would subject the brand to new regulatory requirements and a deeper level of KYC, so Starbucks would need an embedded finance partner with full security and compliance coverage. The opportunity for Starbucks to create an open-loop card would grant the brand the ability to capture interchange fees from its 31+ million mobile payment app users.

Not only would this change how customers use their Starbucks cards and engage with branded financial services, but it would also allow the company to capture all customer spending data from outside the Starbucks stores and app. This invaluable data would enable Starbucks to adapt its business practices as customer preferences, and behaviors shift and change over time.

By offering an open-loop card, Starbucks can continue optimizing customer experiences by creating next-level personalization for its loyal customers to use in everyday life. As a brand extension, Starbucks gains from a new line of revenue through interchange, while reducing marketing costs through a program that already has incredible brand loyalty. Obtaining full visibility into customer spending behaviors can uncover new partnerships and boost marketing expansion, optimizing Starbucks' overall business operations.

It is possible to create your own

Using Starbucks as a stellar example of a loyalty program — one that offers financial products to its customers — you can create a similar program in months vs. years. Alviere embedded finance makes this possible without having to design the program from scratch.

Alviere combines a comprehensive technology platform that allows our clients to offer white-label accounts & wallets, branded cards, and send money anywhere, all without incurring network fees. Behind the technology platform is Alviere's status as a licensed, regulated financial institution, coupled with expert program design, implementation and launch teams.

A Starbucks-like program is within reach, benefiting your customers and your company. Let's talk about how to make that a reality.