The days of hailing a taxi on a street corner are fading into memory. Thanks to the rise of online marketplaces, transportation has undergone a seismic shift, and at the forefront of this revolution stands Uber.

Uber's digital approach meant a new and improved ride hailing experience, and perhaps more importantly, the opportunity for almost anyone to earn extra money as a driver.

As Uber’s new proposition started catching on, additional companies entered the market and continued to shake up the existing transportation sector. The ease of developing and deploying similar software platforms meant replicating Uber’s core functionality wasn't a hurdle, and the user adoption race began.

Maintaining the top spot has not been an easy feat for Uber, but thanks to a (well-documented) growth-at-all-costs mindset and exceptional navigation of industry changing headwinds, Uber stands today as the leader in ride-sharing and on-demand delivery.

Among other factors, a critical component to success has been their dedication to driver loyalty. Consistently innovating their business model to meet the demands of drivers has resulted in an estimated 6.5 million monthly drivers using the platform to deliver people, food, groceries, and more to their destinations.

In this series of Embedded Finance Innovators, we're doing a deep dive into how Uber connected a portfolio of personalized rewards with branded and embedded financial services to create unmatched driver loyalty and secure their spot at the top of the category.

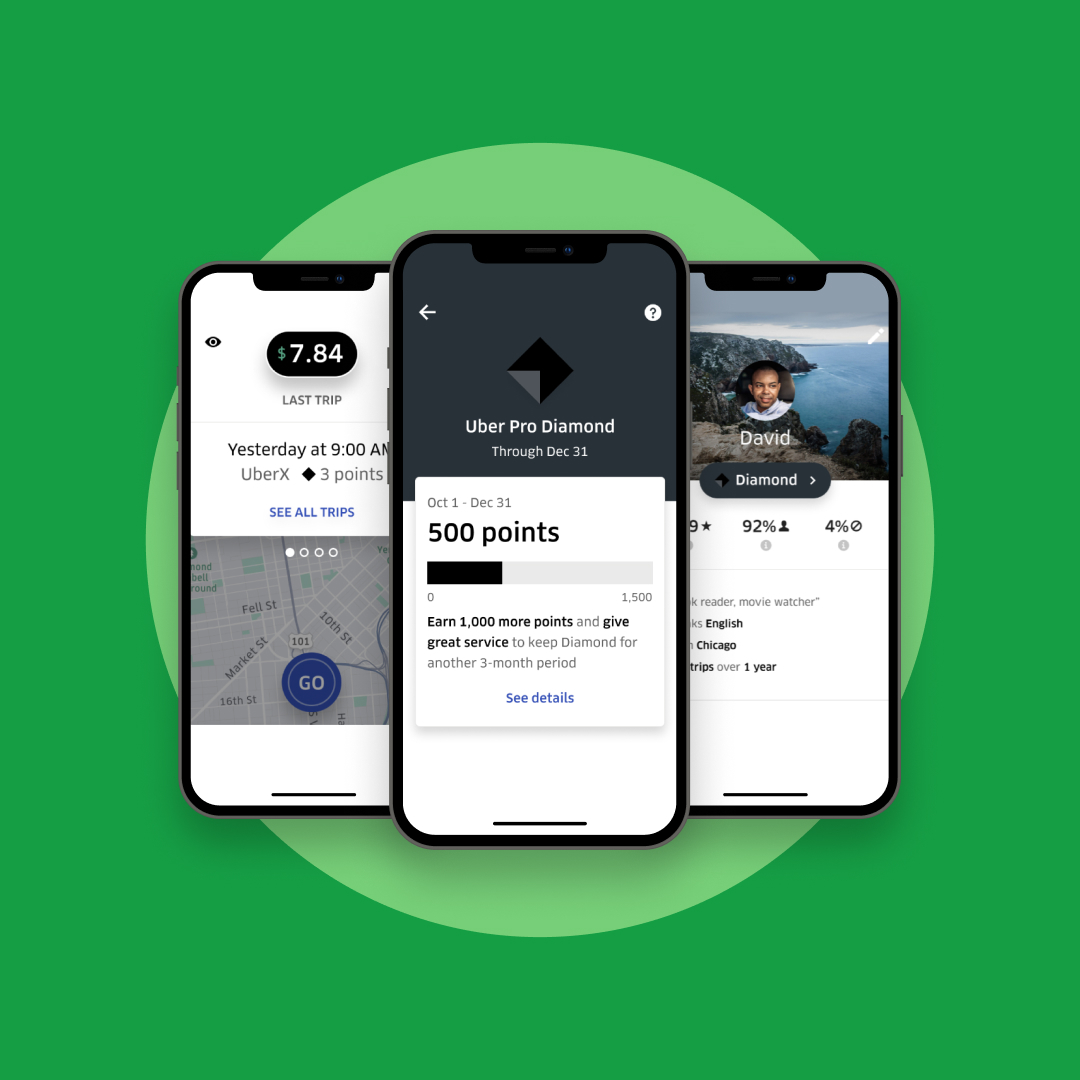

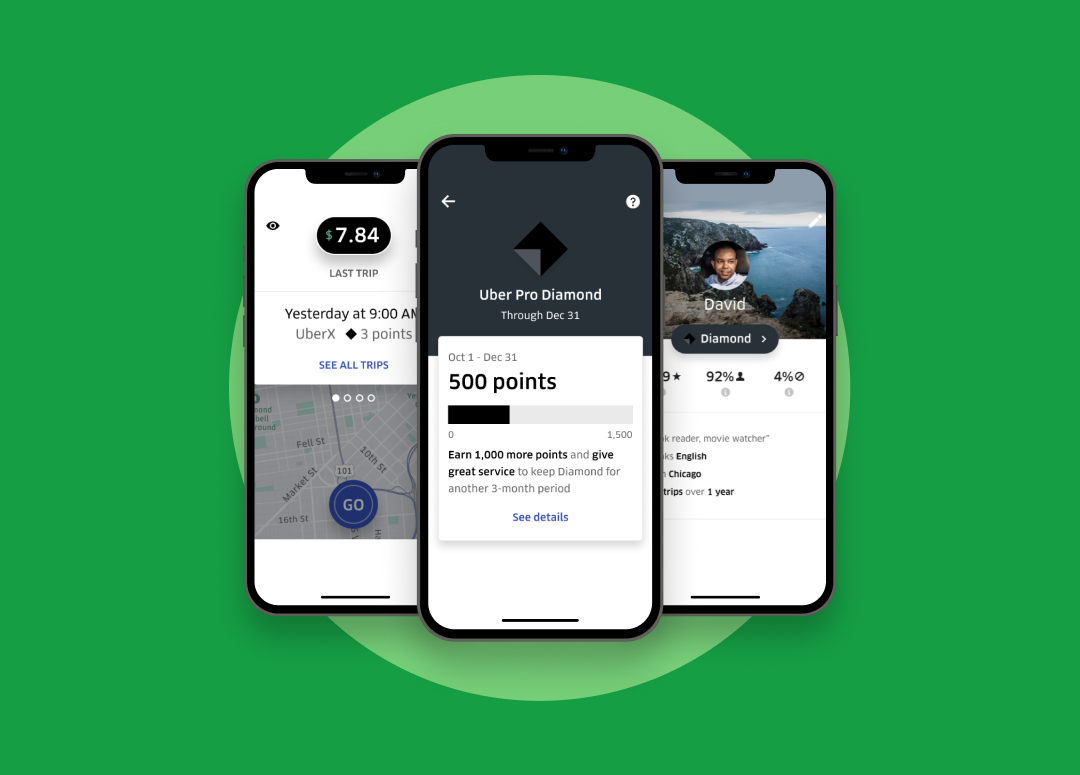

Personalizing loyalty with the Uber Pro Program

Over the years, Uber has invested in evolving their driver rewards and loyalty programs. The present day Uber Pro program is a result of constant interactions on reward types (both on and off the road) and listening to drivers tell them what they really want.

The Uber Pro program is a tiered rewards program that unlocks benefits for drivers as they complete more rides or deliveries. The program addresses the lives of the drivers across three core areas:

Drive like a Pro

Rewards centered around road perks and incentives. Discounts on gas and car maintenance, area ride preferences, and priority support.

Live like a Pro

Rewards created to help drivers off the road. Perks and incentives at driver hot spots like 7-Eleven, and free membership at Costco.

Achieve like a Pro

Rewards centered at longer-term driver goals. These include tuition coverage at Arizona State University online and language learning from Rosetta Stone.

Uber Pro adoption has taken off — as of late 2023, Uber noted a global membership base of 15 million members, upwards of 40 percent of bookings were done with Uber Pro members, and retention is 15 percent higher for members and non-members.

According to a recent official statement from Uber, the Uber Pro loyalty program is a key driver of growth and will remain a key platform initiative, with enhancements to "Live Like a Pro" benefits and brand exclusive deals for drivers.

The rewards and incentives offered through the Uber Pro program create value for drivers at all stages of their lives, but to create an ecosystem that truly maximized driver loyalty, Uber had to address one of the most important factors of driver satisfaction: access to income and earnings.

Tackling an online marketplace's biggest challenge: payouts

Payouts normally require complicated financial services stacks to facilitate their bi-directional payments and escrow account needs.

One of the most common pain points for online marketplaces is paying out funds to the people making money on their platform. Most platforms offer the same payout options: bank transfers, direct deposit, connection to payment gateways like Stripe, Paypal, or Venmo, and other proprietary methods like prepaid cards. The challenge consistent throughout these options, however, is the reliance on a third party for the last mile delivery of funds to the recipient.

A quick glance at most platform user forums will expose frustrated gig workers who have questions about when money will land in their account. In many cases, the time at which funds are available can vary based on amount, banking institution, origination of funds, and other unseen and unknown variables.

In the case of Uber, reliance on a driver's chosen bank for the last mile delivery of funds became a source of tension, and was especially challenging for Uber to address, as that was out of Uber's control.

As an innovator, Uber started looking at new ways to create better payout experiences for their drivers. The ideal solution would be to provide drivers access to their earnings instantly and without fees, and most importantly, integrated into the existing in-app experience.

Using financial services to enhance driver experiences

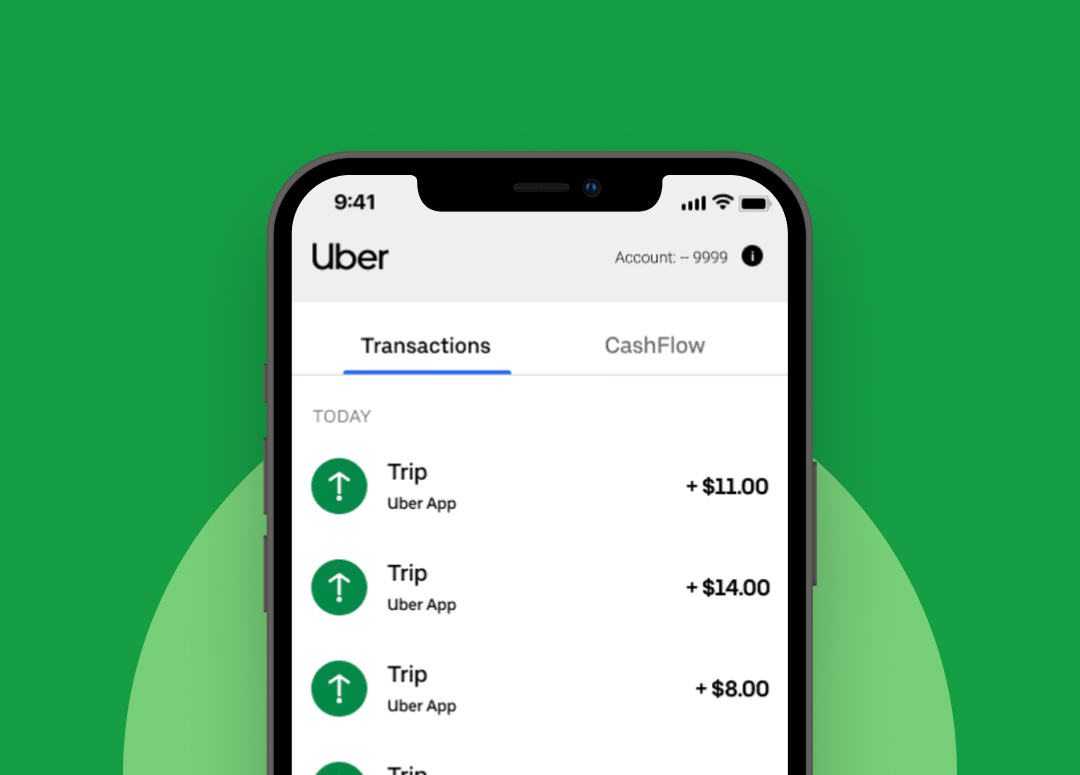

In October of 2022, Uber launched the Uber Pro Card, a branded business debit card that is connected to a checking account embedded in the Uber app.

(Note: Uber started offering a debit card back in 2019, but the Uber Pro Card is the present day branded debit card program)

The Uber Pro Card program enables drivers to get paid instantly for each trip and manage their funds all within the Uber app. The release of the Uber Pro Card meant that Uber didn't have to rely on external financial institutions for last mile delivery of funds to card holders. This enhancement to drivers' financial experiences meant huge increases in satisfaction and an increase in Pro Card adoption.

“At Uber, we are always looking for new ways to offer drivers and couriers more support on the road...The new Uber Pro Card will allow drivers and couriers take home more of what they earn. Drivers and couriers will now have the ability to get more cash back on gas and EV charging and have their earnings automatically deposited to their accounts after each trip - free of charge.”

- Andrew MacDonald, SVP, Mobility & Business Operations, Uber

The overarching goal for the Uber card program is to help drivers keep more of what they earn. Staying true to that statement, Uber took innovation another step and integrated the Uber Pro Card program into the existing Uber Pro loyalty program with enhanced rewards and perks. Using the Uber Pro Card, drivers get access to another tier of cashback incentives, including:

Trip payouts

Earnings go directly to the Uber Pro Card balance after every trip, free of charge. Drivers can withdraw cash for free at 55,000 ATMs across the U.S.

Gas / Charging

Up to 10 percent cash back on fuel and up to 12 percent back on EV charge fees.

Maintenance

Cashback for maintenance and repairs from Advanced Auto Parts.

Dining

Discounts and cashback at convenience stores and restaurants

Locations are tailored to a driver who is on the go, for example, 7-Eleven and Jersey Mike’s Subs.

It's important that the program be financially sustainable. Uber's use of financial technology to offer embedded accounts and branded cards means they didn't have to incur many of the costs associated with payouts, which can then turn into cashback and discount offers for card holders.

Benefits that go beyond the bottom line

Financial ecosystem benefits

By issuing its own card and account ecosystem, Uber potentially saves on fees they would normally incur having to use external payment processors for payouts.

Financial services lock-in

Drivers relying on the card for income and benefits become more deeply integrated into the Uber ecosystem, increasing their reliance on the platform. It may make the difference between driving for Uber or other providers.

Data collection

Uber gains access to drivers' spending habits and financial data through the card, which can inform new partnerships and rewards incentives.

Targeted marketing

Uber can use data from the card to personalize marketing campaigns and offers to drivers, to increase their engagement and satisfaction.

Positive perception

Offering valuable financial tools can enhance Uber's image as a supportive partner for its drivers, attracting and retaining the best talent.

Trailblazing financial services modernization

Uber’s approach to delivering financial services to its drivers is exactly why they are highlighted in this series. Embedded technology creates flexible options for Uber to deliver financial services to its drivers when, where, and how they please. The driver experience is seamless and gives drivers all the income and money management features they need — without sending drivers to a third-party financial institution. Personalized rewards are an incentive to use the Uber Pro Card for driving-related spending needs, and now, cashback perks are integrated into the card experience.

If you’re interested in learning how Alviere works with enterprises and marketplaces to create a solution like this, explore the B2B Payments Ecosystem. You can also get inspired by other Embedded Finance Innovators by continuing to read articles in this series, or contact us to speak with one of experts.